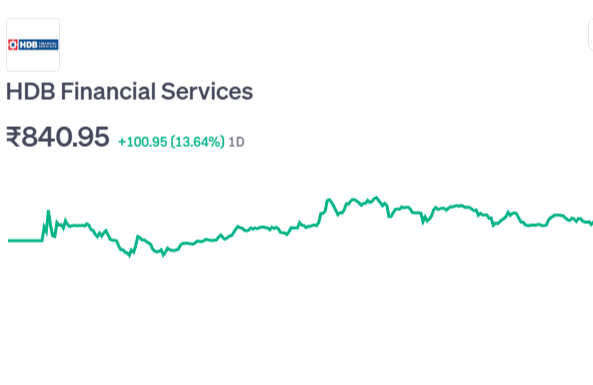

On July 2, 2025, HDB Financial Services, the lending division of HDFC Bank, formally made its stock market debut, marking a significant day for Indian markets. After an eagerly awaited IPO, shares opened at ₹835 against ₹740 issue price, delivering a 12.8–13 % listing gain — a strong welcome indeed.

The IPO Build-Up

- The initial public offering (IPO) took place from June 25–27, 2025, with a lot size of 20 shares and a price range of ₹700–740 per share (cbonds.com, businesstoday.in, moneycontrol.com).

- The ₹12,500 crore offering included ₹10,000 crore through an offer for sale and ₹2,500 crore in new shares (businesstoday.in).

- It was massively oversubscribed, drawing nearly ₹1.61 lakh crore in bids — over 16× overall, and a staggering 55× from institutional investors (reuters.com).

- Grey market buzz pegged a ₹70–75 premium, signaling a potential 9–11 % pop on listing (livemint.com).

The overwhelming response reflected investor confidence in HDB’s strong fundamentals and HDFC parentage — a big win in India’s IPO landscape.

HDB Financial Services Listing Day Highlights

Starting at ₹835 on the NSE and BSE, July 2 was around 12.84 percent higher than the ₹740 IPO price (reuters.com).

- The listing price aligned with grey‑market estimates — ₹811–₹835 range (businesstoday.in).

- Intraday highs of ₹845.75–₹851.40 reflected active buying (livemint.com).

- The stock closed near ₹840–841, representing ~13.5 % first‑day returns and pushing HDB to a ₹69–70 k cr market cap (financialexpress.com).

- Trade volumes were hefty — 809 lakh shares, with ₹6,800 cr turnover (hdfcsky.com).

- With over 70 % deliverable volume, investor holding was strong — a promising sign (hdfcsky.com).

By close of Day 1, HDB had shot up to become the 8ᵗʰ largest NBFC by market cap, joining elite peers like Bajaj Finance and SBI Cards (financialexpress.com).

Why Such a Strong Debut?

- Patronage & Credibility: As a subsidiary of HDFC Bank, HDB is based on a reputable company with a strong market presence (livemint.com).

- Institutional Appetite: Heavy QIB bidding (~55×) shows confidence from big players (reuters.com).

- Underserved Focus: To increase loan availability in India, more than 80% of HDB’s branches are located in semi-urban and rural areas (Tier 4 and smaller) (m.economictimes.com).

- Diversified Loan Mix: A balanced portfolio spanning retail, asset, and enterprise lending, with robust growth (m.economictimes.com).

- Reasonable Valuation: Priced lower than unlisted levels with modest P/B ratio (~3.2–3.4×), making long term investors smile (m.economictimes.com).

- Macro Tailwinds: RBI easing and favorable rural demand create tailwinds for NBFCs like HDB (financialexpress.com).

Analyst Views

- Mehta Equities anticipated 8–10 % listing gains and affirmed confidence in HDB’s model (financialexpress.com).

- With a “Buy” target of ₹900 by June 2026—roughly 22% upside—Emkay Global began coverage (livemint.com).

- Prashanth Tapse from Mehta noted strong institutional interest, recommending a medium‑term hold (livemint.com).

- Tarun Singh from Highbrow called it a “steady compounder” combining growth and stability (livemint.com).

- Bhavik Joshi (INVasset PMS) emphasized the medium-term opportunity and advised accumulating on dips (livemint.com).

Though not a speculative pop, the listing shows sustained investor belief in HDB’s quality.

Risks to Watch

- Overhang Risk: RBI norms may force HDFC Bank to reduce its stake to <20 % within two years, which could weigh on pricing (financialexpress.com, m.economictimes.com).

- Asset Quality Pressure: Gross Stage 3 (bad loans) hovered at 2.3 %; unsecured lending is 27 % of book — watch default trends (m.economictimes.com).

- Liquidity & Regulatory: NBFCs are sensitive to funding mismatches and policy shifts — worth keeping tabs on .

The Takeaway: What Investors Should Know

- Retail allotment: modest ~1.4×, but IPO still gave a solid ~₹95/share paper gain Day 1 (reuters.com).

- Long-term appeal: Analysts broadly see HDB Financial Shares as a credible, growth‑plus‑value play, ideal for a 3–5‑year horizon.

- Buyers missed out?: Medium‑term entry could be smart — buying dips might give better average price (livemint.com).

- Growth catalyst: HDB Financial Shares ’s reach into credit-starved markets and under‐penetrated segments positions it well for India’s credit expansion — a thematic investment in nation’s growth.

🧾 Quick Recap Table

| Aspect | Details |

| IPO Price | ₹700–740/share |

| Issue Size | ₹12,500 crore |

| Listing Date | July 2, 2025 |

| Listing Open Price | ₹835 |

| First-Day Close | ~₹840–841 |

| Listing Gain | ~13–14 % |

| Market Cap | ~₹69–70 k crore |

| Oversubscription | 16.7× overall |

| QIB Interest | 55× |

| Retail Subscription | 1.4× |

Final Words

HDB Financial Shares made a textbook IPO success with an excellent and well-anchored start. The strong pop reflects solid fundamentals, brand strength, and strategic positioning. While not a fireworks short-term story, its potential as a long-term wealth builder is evident. Investors eyeing structural India growth may find this a compelling addition to their portfolios — with eyes on policy movements and credit trends.

In short: July 2, 2025, will be remembered as the day HDB Financial Shares stepped comfortably onto the Dalal Street stage — and all indicators point to a promising encore.